Packging Industry

Case Study

The packaging solutions sector is highly fragmented with 25 to 30 companies accounting for about 25% of the market. Packaging generates about $900 billion in revenues annually worldwide and has created exponential economic profit since 2013. In the next decade, the packaging solutions industry is set for additional growth in e-commerce, sustainability, and technology from shifting consumer preferences (McKinsey & Company, 2019).

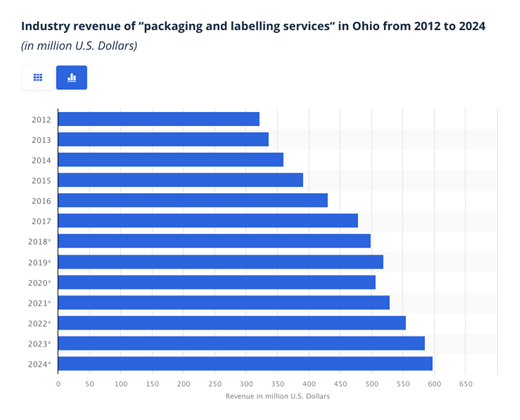

In the United States, the packaging industry is estimated at $193 billion in 2023 and is expected to reach $222.6 billion in 2028, growing at a CAGR of 2.88% (Mordor Intelligence, 2023). Exhibit A, the packaging and labeling services industry in Ohio is projected to grow from $479 million in 2017 to $598 million in 2024 (Statista, 2021).

Exhibit A

E-Commerce Market

The global e-commerce market in packaging will reach $61.55 billion by 2025, growing at a cumulative annual growth rate (CAGR) of 14.3% from 2020 to 2025 (Business Wire, 2020). Discounting back from 2025, the value of the market in 2020 is worth $27.6 billion. The growing access and rising internet penetration have created enormous potential for the e-commerce and packaging providers to gain substantial market shares (Business Wire, 2020).

Green Packaging Market

E-commerce is one of the lead drivers of corrugated boxes, which the market witnessed a large spike in demand during the pandemic (Mordor Intelligence, 2023). The expansion in e-commerce caused an increase in packaging use, which created a need for more sustainable solutions. The growth drivers to the green packaging market include growing government initiatives and focus on downsizing and right-sizing packaging (Coherent Market Insights, 2023). The awareness of reducing plastic wastes and becoming more sustainable is growing, and companies are offering more products that are 100% recyclable and biodegradable (Business Wire, 2020). The global green packaging market size is projected to grow from $267.8 billion in 2021 to $385.3 billion by 2028. The CAGR is 5.3% during this period. Although during the COVID-19 pandemic, green packaging experienced negative demand, the market is expected to recover to pre-pandemic levels (Fortune Business Insights, 2022). On a national level, the United States green packaging market size is worth $67.5 billion in 2022 and by 2028, it will grow to $89.5 billion. The annual growth rate is 4.9% from 2023 to 2028 (IMARC Group, 2022). The fastest growing industries in sustainable packaging are food and beverage, healthcare and pharmaceuticals, personal care and beauty (Coherent Market Insights, 2023).

Industry Trends

Below are some of the top packaging industry trends for 2023:

-

Smart Packaging: The integration of digital technologies like IoT sensors into product packaging enables improved visibility, inventory tracking, quality monitoring, and anti-counterfeit measures.

-

Digital Printing: Digital printing is becoming increasingly popular due to its affordability, speed, and ability to help businesses differentiate themselves in the competitive e-commerce landscape.

-

Sustainability: With a rising demand for eco-friendly solutions, businesses are adopting sustainable packaging materials, reducing consumption, and striving for more efficient workflows to meet higher environmental standards.

-

Mono-Material Packaging: The demand for sustainability is driving the popularity of mono-material packaging, which simplifies recycling by using a single material for packaging design.

-

AI and Automation: Artificial intelligence and automation play a crucial role in optimizing packaging processes, reducing waste, and gaining data-driven insights to improve operations.

-

Ongoing Supply Chain Issues: The packaging industry is not immune to supply chain challenges, including material shortages and price fluctuations. This may lead to a shift toward more cost-effective customization and finding ways to cut costs in other areas.

-

Minimalist Design: Minimalist packaging designs, characterized by streamlined and elegant aesthetics, are gaining popularity as they appeal to modern audiences and offer cost-saving benefits.

-

Tactile Packaging: As e-commerce continues to grow, tactile packaging techniques like embossing, cut-outs, and unique textures help products stand out and create a memorable brand experience for customers (Newton, 2023).

-

Plastics Circularization: Plastic packaging will continue to grow so the main focus for government and industry should be delivering recycling systems that can reestablish plastic within the circular economy. About 61% of global consumers believe increased use of plastic is necessary and 15.7 % of plastic pollution is contributed by packaging suppliers.

-

Green But Clean: Food and beverage packaging with environmental claims increased to 92% but these claims may not be substantiated. For products that do feature verifiable claims, consumers are uncertain of the proper disposal procedure of such packages (Poole, 2023).

-

Renewable Rebellion: There is a trend towards bioplastics and renewable packaging solutions. Only 7% of global consumers perceive paper-based packaging as unsustainable, while only 6% see bioplastics as unsustainable. European Bioplastics expects global bioplastics production to almost triple by 2027 (Poole, 2021). In 2022, packaging remained the biggest market segment for bioplastics (48% by weight).

-

Meaningful Connections: Refers to digital engagement. 77% of global consumers are now interested in engaging with connected packaging technologies on pack via smartphones. While these technologies have mainly been implemented to boost consumer-brand engagement with loyalty reward programs and big data collection for targeted marketing, they are increasingly being employed as tools to support circularity and inclusivity.

-

Reusable Revival: Reusability is seen as an important packaging-related purchasing influence by 43% of global consumers – the most widely highlighted aspect and on par with hygiene (42%) and shelf life (42%). The shift toward a reusable packaging ecosystem within the foodservice industry continues to gain momentum. Also, personal care and household products have had a higher adoption of refill or reusable packaging solutions (Poole, 2023).

Consumer Behavior Trends

Sustainability has become more prevalent as public and private sectors are regulating sustainability initiatives. It is now a critical factor in consumer purchasing decisions (Dillon, 2023). Based on a 2020 McKinsey US Consumer Sentiment Survey, over 60% of respondents would pay more for a product with sustainable packaging and 78% of US consumers say that a sustainable lifestyle is important to them. However, company executives found it difficult to generate sufficient demand for these products. As a result, McKinsey and Nielsen IQ created a joint study to track spending instead of sentiment and to see “if consumers are putting their money where their mouths are.” The results provide insights into whether, and by how much, products with ESG-related claims outperform their peers on growth and how different types of products and claims perform relative to each other (Am et al., 2023). Four insights were provided:

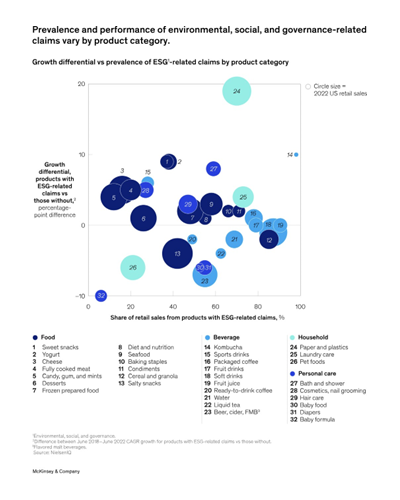

Insight 1: Consumers are shifting their spending toward products with ESG-related claims. Over a five year period, ESG products that made one or more claims on their packaging outperformed products that made none (Exhibit B). Products making these claims averaged 28 percent cumulative growth versus 20 percent for products that made no such claims.

Exhibit B

Each product category exhibited differential growth between products with ESG-related claims and those without.

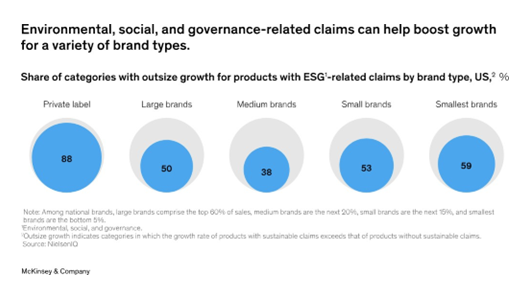

Insight 2: Brands of different sizes making ESG-related claims achieved differentiated growth. Large and small brands saw growth in products making ESG-related claims. In 53% of categories, small brands that made these claims achieved disproportionate growth (Exhibit C). Some examples of category variance: in sports drinks and hair care, smaller brands grew more quickly, while in fruit juice and sweet snacks, the larger brands did.

Exhibit C

Insight 3: No one ESG-related product claim outperformed all others, but less-common claims tended to be associated with larger effects. Claims can be a differentiator, especially if they also have a disproportionate impact on a company’s ESG goals and impact commitments. Products that made the least prevalent claims (such as “vegan” or “carbon zero”) achieved 8.5% growth. Products making medium-prevalence claims (such as “sustainable packaging” or “plant-based”) created 4.7% growth and the most prevalent claims (such as “environmentally sustainable”) grew by 2% (Exhibit D).

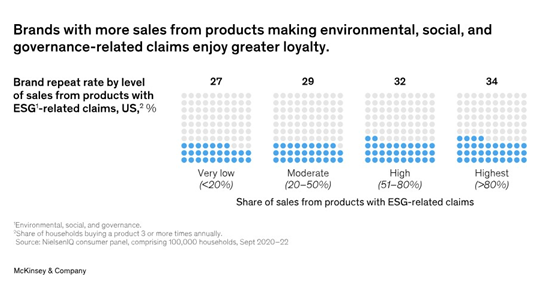

Brands that generate more sales from ESG claims enjoy greater customer loyalty. The greater the share of sales from products with ESG claims, the higher the brand repeat rate.

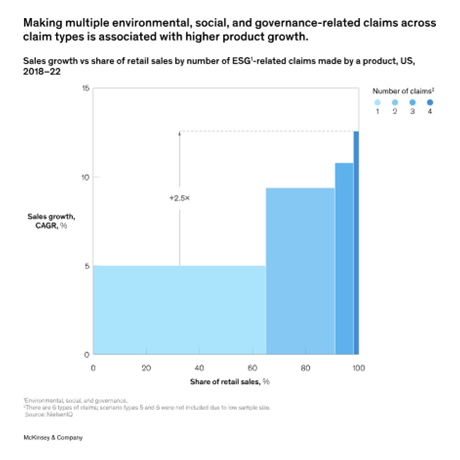

Insight 4: Combining claims may convey more authenticity. According to Exhibit E, products making multiple types of claims grew about twice as fast as products that made only one (Am et al., 2023).

Exhibit E

The greater the number of ESG-related claims, the greater the product growth. There is a 2.5X difference in CAGR between products with one and four claims.

Conclusively, “consumers care about sustainability and back it up with their wallets.” Although sustainability is still a niche market and generating demand for sustainable products is difficult, 60-70% of US consumers were generally willing to pay more. 73% of consumers were willing to change their purchasing habits to reduce their harmful impact on the environment. A study showed that 83% of consumers ages 44 and under were willing to pay more for products that are sustainably packaged (Dillon, 2023). There are observed generational differences in attitude.

About 24% of Baby Boomers and Generation X changed their behavior towards being more sustainable whereas the percentage is 32% for millennials. According to Shikha Jain, author of the study and Partner at Simon-Kucher & Partners, he examined that: “Millennials and Gen Z are becoming a force to be reckoned with as they continue to represent a larger share of the consumer demographic. Companies that don’t have sustainability as part of their core value proposition need to act now to protect against future reputational impacts and loss of market share.” (Pope, 2021). Consumers no longer purchase items solely based on price; sustainability is a critical factor (Dillon, 2023).